Another thing that economists have long said is, “When you tax something, you get less of it.” So here’s an idea: let’s tax income disparity!

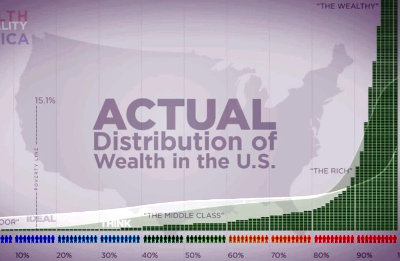

How would this work? Easy. For companies of a given size, we decide what the ideal distribution is of wages and other compensation. We might decide, for instance, that the 90th percentile should be earning no more than 50x what the 10th percentile earns. Whatever numbers we choose, the result is a curve; presumably a less-pronounced one than this:

Once we decide on the shape of our curve, companies are free to obey it or not, distributing their compensation however they see fit. But if their curves deviate too far from the ideal, they pay a proportional income-disparity tax. Maybe they can even be eligible for an income-disparity credit if the curves deviate in the other direction.

Properly tuned, and phased in slowly, this “Sigma Tax” (for the Greek letter that designates standard deviation in statistics) should result in gentle but inexorable pressure that reduces the wage gap, improving things for the bottom 99% without breaking the 1%, while paring some of their shameful excess.